Regulatory Compliance Solutions

Crypto AML

Know Your Client

Know your clients and assess risks

Transaction Monitoring

Monitor crypto asset transactions and transfers

Case Management

Investigations and Case Analyses

Know Your VASP

Know your Virtual Asset Service Providers and assess risks

Crypto AML

Wallet Identity Analysis

In the Suspicious Transaction Reporting Guidelines for CSDs published by MASAK, suspicious transaction typologies specific to cryptoasset transactions have been determined.

Crypto Asset Service Providers have the obligation to capture transactions that comply with these typologies and report suspicious transactions with or without deferral.

In order to fulfill these obligations, it has become necessary to establish a crypto AML structure.

Crypto AML

Unified AML-CTF Enhanced with Crypto

BTguru Crypto AML tools scan the sanction lists published by OFAC and OFSI daily, extracts the published crypto wallet Ids and integrate them into its results with the highest risk scores.

On top of the crypto wallets published on lists, BTguru Crypto AML tools assign high risk scores to other crypto wallets getting into transactions with published wallets, and flag other crypto wallets of sanctioned individuals and entities using the private intelligence gathered by field work of the experienced attribution team.

Thanks to this, you can track active crypto wallets of sanctioned individuals and entities that aren’t published on lists and other wallets of interacting with these crypto wallets, especially in case of crypto wallets of sanctioned individuals and entities that are published on lists become dormant.

KRİPTO AML

Know Your Client (KYC)

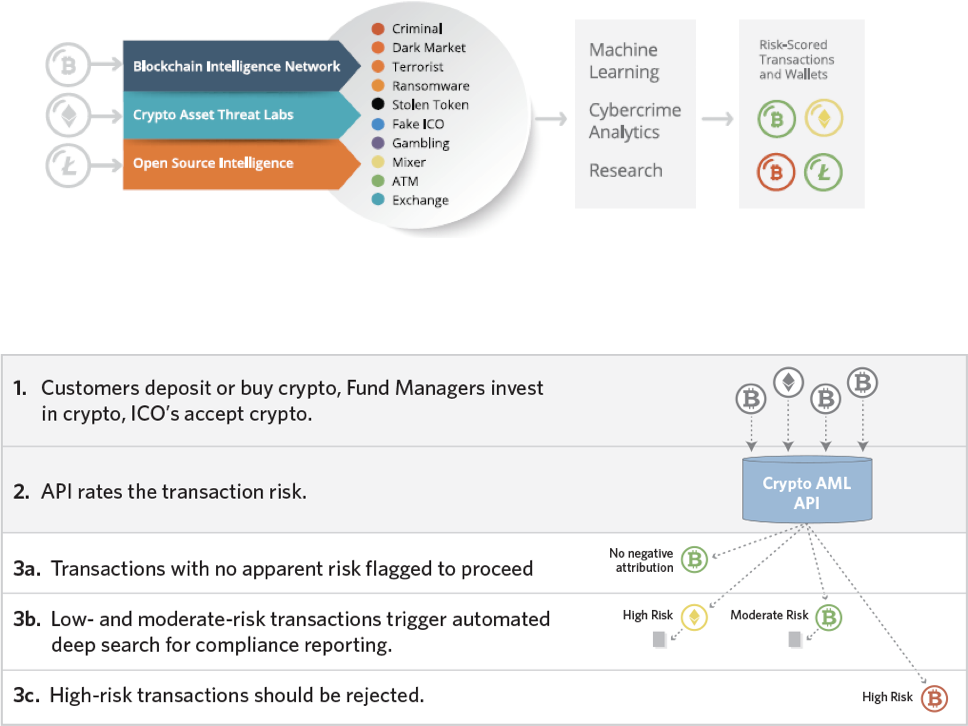

BTguru Crypto AML KYC tools de-anonymize wallet IDs to make identities of wallet owners visible for analysis.

Furthermore, BTguru Crypto AML KYC tools provide risk scores for every wallet based on activities related with criminal transactions, dark market/dark web, terrorism financing, ransomware, stolen tokens, fraudulent ICOs, gambling, cyber attacks and so on.

These risk scores are assessed by an experienced attribution team using an enormous repository curated of attribution data which gets 1.5 million new data points each week on average, from active intelligence gathering, private intelligence sources and open-source intelligence (OSINT).

Crypto AML

Know Your Transaction (KYT)

BTguru Crypto AML tools de-anonymize crypto transaction IDs to make crypto currency transaction details visible for detailed analysis.

This data set enables you to investigate chain or parallel transactions along with identities of sender and beneficiary.

Also, using the API and integrating with core systems,

crypto currency transactions can be tracked near-real-time and even halted if a transaction is flagged suspicious and sent for detailed investigation.

Crypto AML

Crypto Screening & Monitoring

BTguru CSM (Crypto Screening & Monitoring) tool enables you to define Crypto AML scenarios and suspicious transaction patterns for transaction monitoring purposes. You can create unlimited scenarios and connected workflows on the tool.

Positioned between the exchange core and CipherTrace content services, BTguru CSM can feed the transaction data coming in from the exchange core into its rule engine along with the CipherTrace intelligence data for the rule engine to run scenarios and make evaluations.

Workflows and scenarios specially designed and implemented for your organization, such as suspension or interruption of transaction, blocking assets, assigning a tasks to the compliance team, raising alarms, getting approvals, sending warnings and notifications, triggering another application, can be executed automatically.

Crypto AML

Forensic Case Analysis

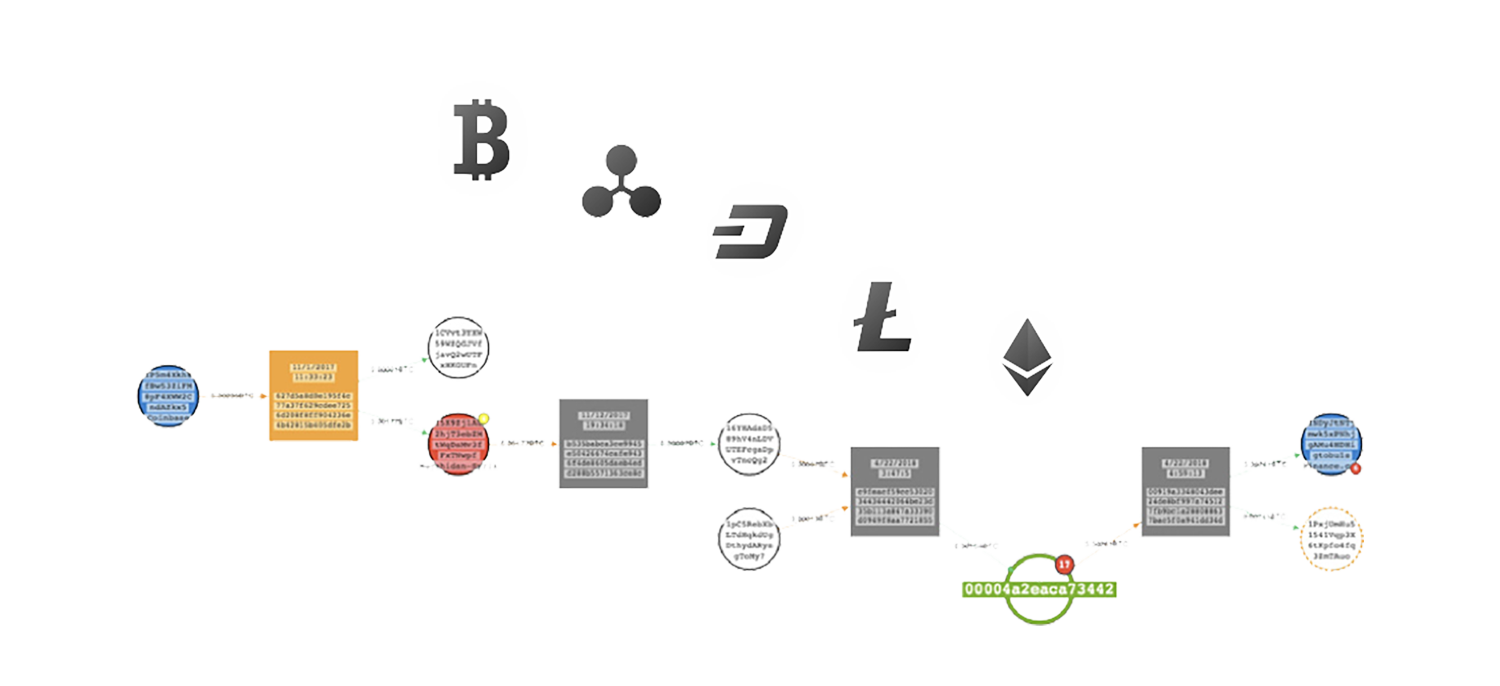

Using the de-anonymized wallet and transaction IDs, you may obtain identities of the sender and beneficiary of a transaction, as well as other transactions connected or linked to the original.

Case analyses, forensics activities and investigations can be executed with visual analysis tools to answer questions, such as;

- in how many pieces a transfer was made?

- did the beneficiary forward the incoming crypto currency?

- are there any chain transactions?

- were there multiple incoming or outgoing transactions at the same time at a single wallet?

Crypto AML

Know Your Virtual Asset Service Provider (KYVASP)

BTguru Crypto AML tools use an enormous repository curated of attribution data which gets 1.5 million new data points each week on average, from active intelligence gathering, private intelligence sources and open-source intelligence (OSINT). This attribution data is continuously processed by advanced analytics to make a consolidated risk assessment and grade crypto service providers as either legitimate, higher-risk and potentially illicit businesses.

BTguru Crypto AML tools enable you to obtain consolidated risk scores with activity breakdowns of more than 5,000 Virtual Asset Service Providers (VASP) such as crypto exchanges, crypto payment gateways and storage service providers.

Crypto AML

Travel Rule

Travel Rule legislations that are expressed in FATF recommendations make Virtual Asset Service Providers responsible of informing their related governing body regarding crypto asset transactions above a certain threshold.

Governing bodies around world such as

FinCEN of USA, MAS of Singapore,

FINMA of Switzerland and MiCA of EU have published legislations within the scope Travel Rule Compliance, and new legislations are being introduced.

BTguru Crypto AML tools provide solutions for automated Travel Rule compliance processes.

Crypto AML

Crypto Asset Service Provider Obligations

Pursuant to the Regulation on Measures to Prevent Laundering Proceeds of Crime and Financing of Terrorism published in the Official Gazette dated 01.05.2021 and numbered 31471, Crypto Asset Service Providers were included among the obligors in the context of the implementation of the Law No. 5549 on Prevention of Laundering Proceeds of Crime and were subject to the obligations set out in the regulation.

- Identification

- Recognition of the real beneficiary

- Follow-up of transactions requiring special attention

- Monitoring customer status and transactions

- Taking measures against technological risks

- Rejection of the transaction and termination of the employment relationship

- Correspondent relationship risk management

- Compliance with procedures and conditions in electronic transfers

- Follow-up of transactions with risky countries

- Suspicious transaction notification

- Providing information and documents

- Continuous information

- Preservation and presentation obligation