Regulatory Compliance Solutions

Services

Regulatory Compliance Solutions

Customer Onboarding

Onboarding new clients with identity and document verification processes

AML-CTF Compliance

Anti Money Laundering & Counter Terrorism Financing compliance operations

Crypto AML

AML-CTF compliance operations specialized for Crypto-currency transactions

Customer Onboarding

Remote Onboarding

Identity Verification

Verify the identity of a new client during remote/online onboarding processes

Document Verification

Verify the authenticity, validity, and integrity of the documents shared by clients during Identity Verification

Address Verification

Verify the format, authenticity and active residence status of the address info shared by clients

Data

Extraction

Extract raw data from photos or scans of the documents uploaded by clients and feed into other applications

Customer Onboarding

Live Video Call

BTguru Live Video Call tools enable your representatives and employees to make live video calls with your potential, new and current clients.

Along with new customer onboarding processes, you can provide visual support to your current clients related to different processes and applications, such as transaction verification, password reset, technical support, remote appraisals and evaluations, making appointments, remote inspections, examinations and consultations.

BTguru Live Video Call tools can run on your mobile apps and web interfaces, with on-premise or cloud delivery models.

AML-CTF Compliance

Sanction Screening & Monitoring

Screen & monitor real persons, companies, and other entities against sanctions and watchlists

Politically Exposed Persons (PEP)

Search for public functions, political influence and influential associates of persons

Adverse

Media

Search for unfavorable media content about persons, companies, and other entities

Transaction Monitoring

Monitor incoming and outgoing transactions against real-time AML-CTF data

AML-CTF

Sanction Screening

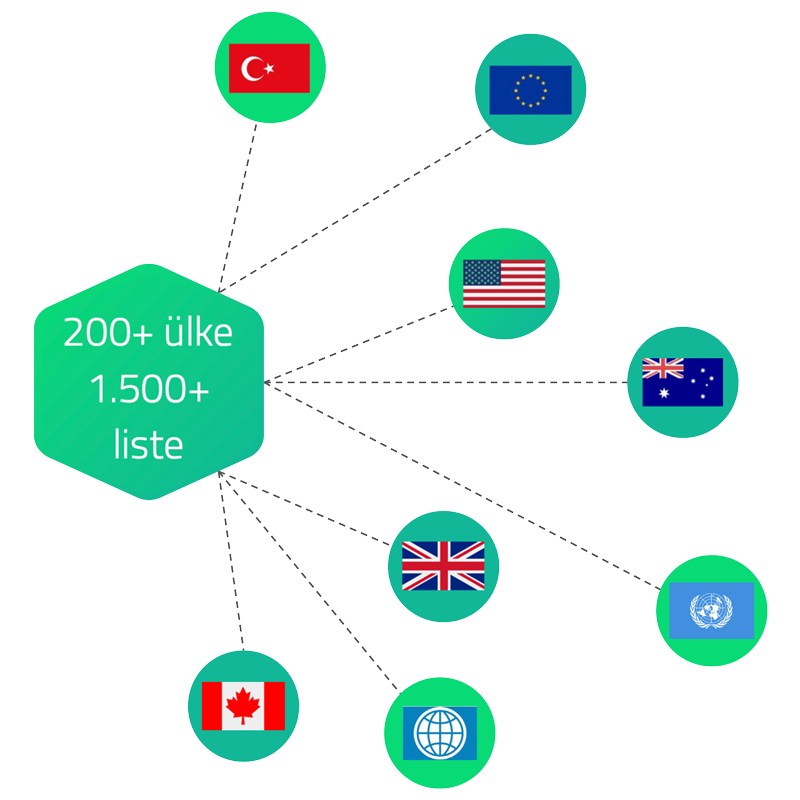

Sanction Screening solutions enable you to check and screen persons, companies, and other entities in real-time against sanctions, watchlists and blacklists published by multiple countries, international institutions and organizations at once.

BTguru AML solutions enable you perform scans against more than 1,500 lists published by more than 200 different countries, international institutions and organizations, including, Türkiye, United States, United, Kingdom, European Union, Canada, United Nations, and World Bank.

AML-CTF

Sanction Monitoring

Sanction Monitoring solutions enable you to track the status of your current clients, partners, merchants and other stakeholders continuously against sanctions, watchlists and black lists published by multiple countries, international institutions and organizations, and get notified regarding changes in their status.

BTguru AML solutions are licensed based on the number of individuals and entities that you screen or track during the year, not on the number of scans. Therefore, you can make unlimited number of scans for an individual or an entity during the year.

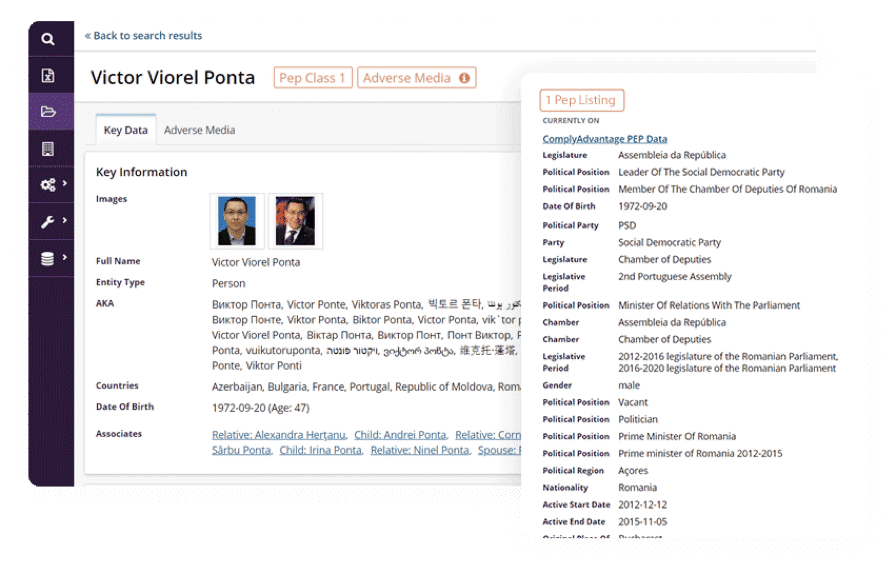

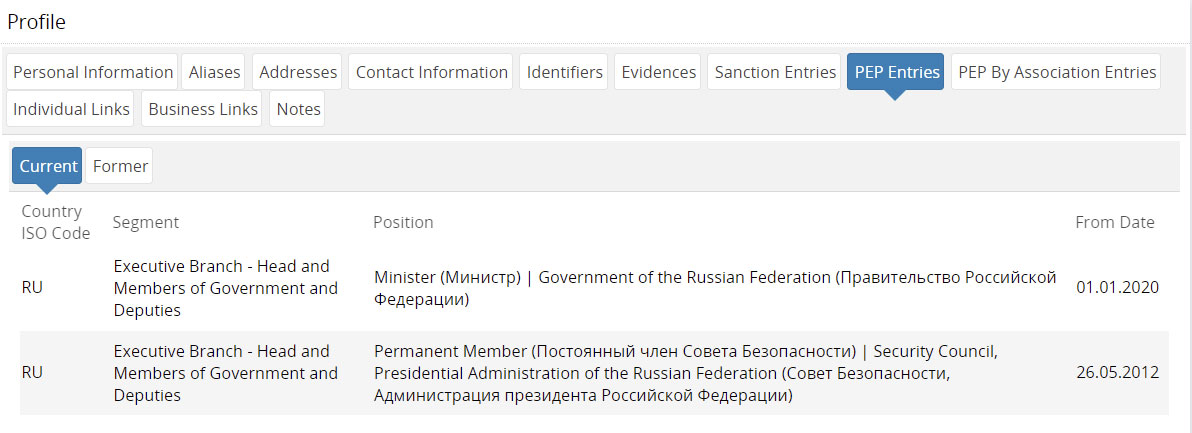

AML-CTF

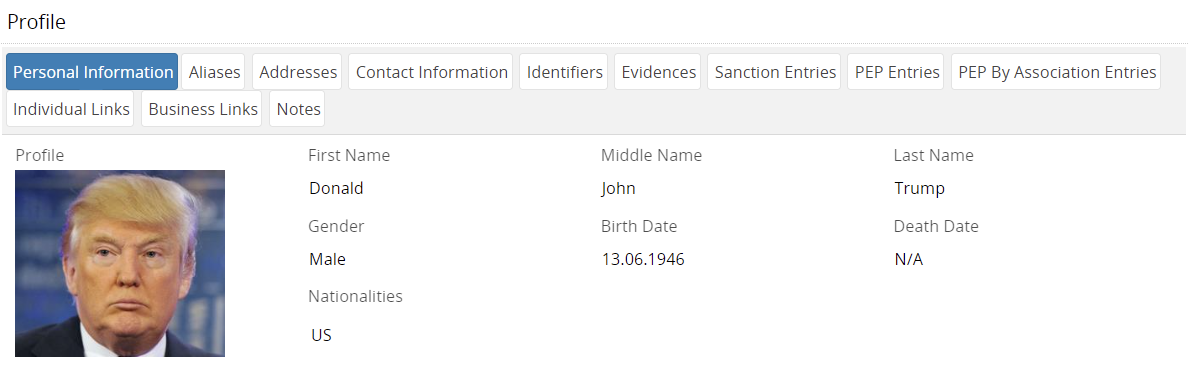

Politically Exposed Persons (PEP)

Politically Exposed Persons (PEP) screening tools enable you to screen and monitor political influence and known associations (past political roles and positions, relatives, business relations etc.) of persons, companies, and other entities in different countries at once.

BTguru AML tools enable you make PEP screening and monitoring against 4 different PEP Tiers, compliant with instructions and legislations published by Wolfsberg Group, FATF, UNCAC, JMLSG, EU-4MLD, UK-FCA and MASAK.

AML-CTF

Adverse Media

Adverse Media screening tools enable you to check against any kind of unfavorable media content about persons, companies, and other entities across a wide variety of news sources –printed and visual media outlets and unstructured sources such as social media.

Adverse media checks performed with BTguru AML tools can reveal involvement with money laundering, financial fraud, drug trafficking, financial threat, organized crime, financial terrorism and more.

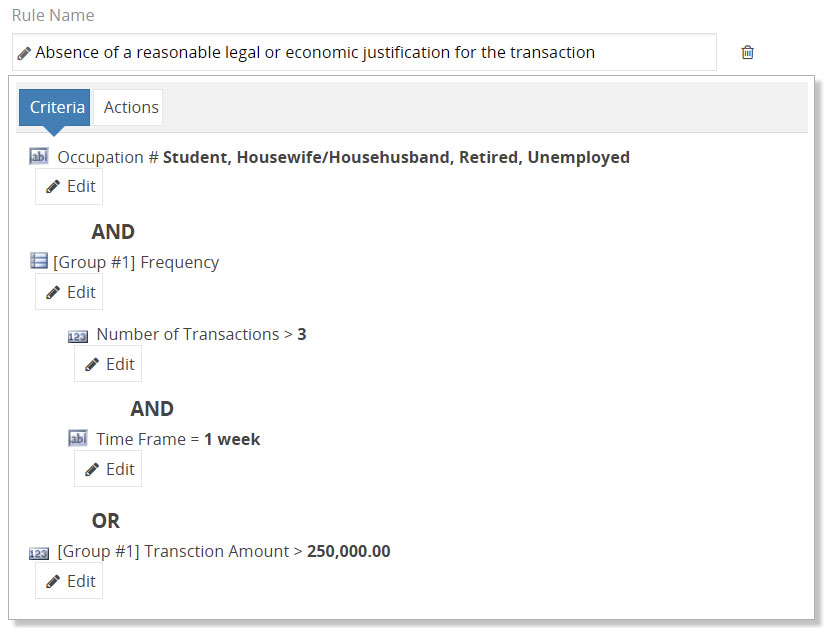

AML-CTF

Transaction Monitoring

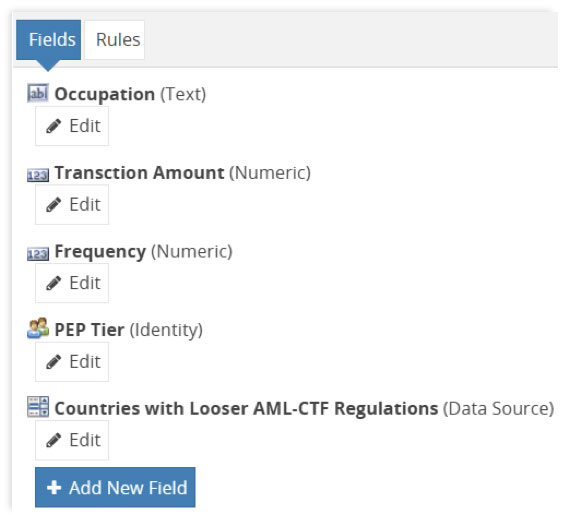

BTguru AML tool enables you to define AML scenarios and suspicious transaction patterns for transaction monitoring purposes. You can create unlimited scenarios and connected workflows on the tool.

BTguru AML tool can be integrated with different core structures, such as banking or insurance core, and feeds the data that it gathers from integrations into its rule engine along with Acuris AML content data for the rule engine to run scenarios and make evaluations.

Workflows and scenarios specially designed and implemented for your organization, such as suspension or interruption of transaction, blocking assets, assigning a tasks to the compliance team, raising alarms, getting approvals, sending warnings and notifications, triggering another application, can be executed automatically.

CRYPTO ASSET TRANSACTIONS LEGISLATION

Suspicious Transaction Notification

In the Suspicious Transaction Reporting Guidelines for CSDs published by MASAK, suspicious transaction typologies specific to cryptoasset transactions have been determined.

Crypto Asset Service Providers have the obligation to capture transactions that comply with these typologies and report suspicious transactions with or without deferral.

In order to fulfill these obligations, it has become necessary to establish a crypto AML structure.